Automating Decision-Making with IDM

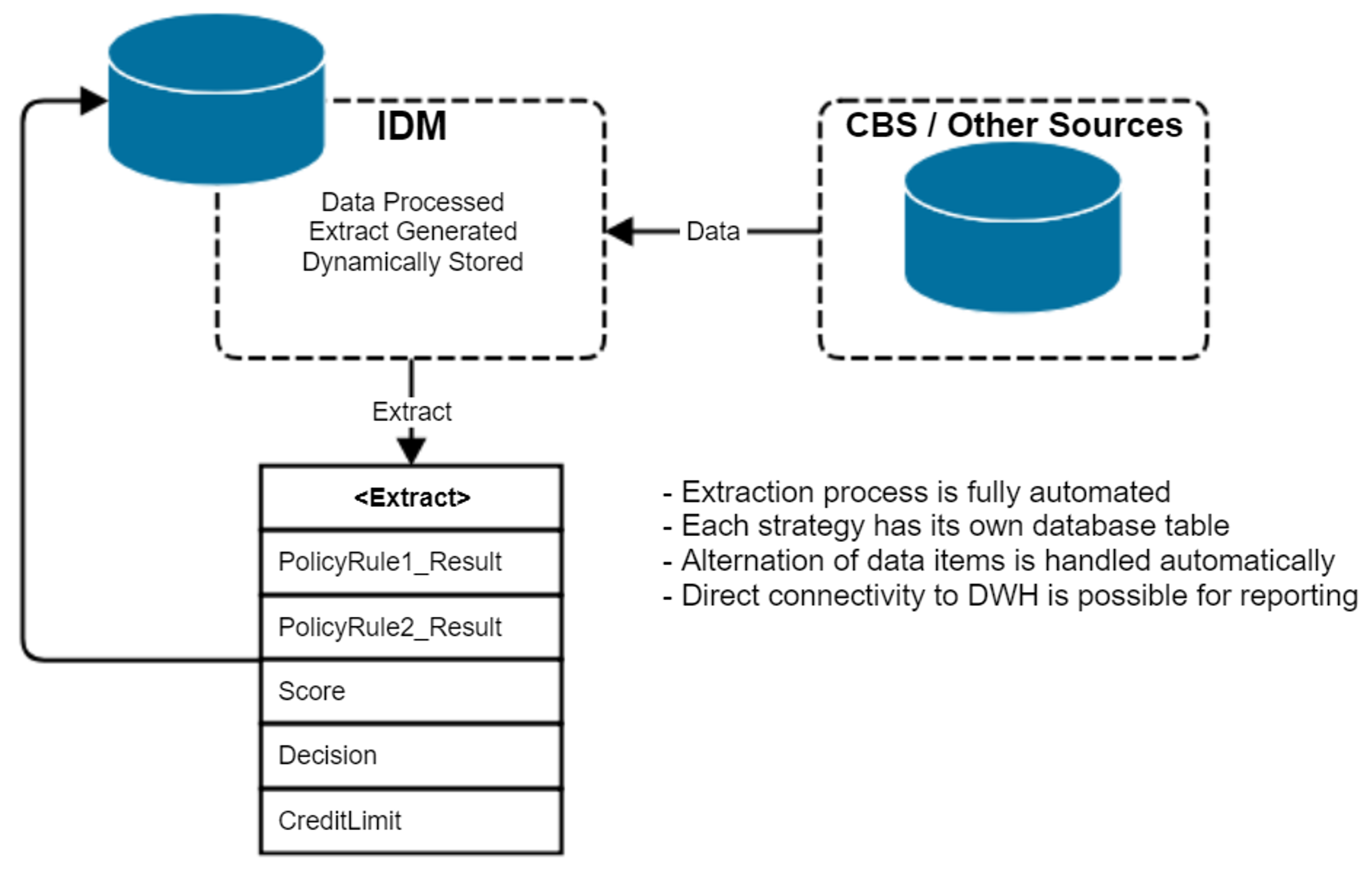

IDM (Instant Decision Module) is bringing decision-making in financial institutions to a whole new level through our fully automated workflow. With connectivity to different information sources, IDM pulls and, subsequently, sends data through a generic or custom-made analytical strategy to generate a summarised, customizable report. This report contains vital details for decision-making, including automatically calculated ratios, applied policy rules, recommended credit limits, and more.

What is Instant Decision Module (IDM)?

Instant Decision Module permits accurate lending decisions in an instant. It is a SAAS solution dedicated to lenders, including digital and mobile lenders from the financial and non-financial sectors, to enable automated accurate credit decisions. The Instant Decision Module opens more room for more opportunities for established lenders, as it provides automated decision-making in existing institutions and products with really simple integration and minimum IT effort.

There are two components to an automated decision, the scorecard and the decision strategy.

- The scorecard is the calculation of a single number based on multiple factors and estimates the probability of default/non-payment of credit facility

- The decision strategy is the process to use the score and other factors to arrive at a number of terms of business. These will include the accept/reject decision, policy rules, scorecard cut-off, limit assignment/maximum loan amount, term of loan, etc.

What IDM Does

The IDM platform provides a fully-automated workflow with connectivity to our Credit Bureau in order to pull the Credit Report on an applicant. Subsequently, this report passes through a generic or custom-made analytical strategy to generate a summary report inclusive of ratios, applied policy rules, recommended credit limits and more.

Typically manual activities, calculations and evaluations done using Credit Report data can be immediately returned as part of IDM report, generated automatically.

Key Proposition: Increased Efficiency

Cost Reduction

Automation of data analysis done according to best practices using fully customizable strategies adjusted to customers’ needs. This allows for significant reductions in cost, time and effort through the automation of often manual processes.

Risk Management

IDM supports sound risk management through numerous personalized analytical opportunities and access to EveryData's team of experts.

Your Credit Policies

Full support of custom input data structures ensures accurate and precise calculations of all important parameters, such as debt service ratio, debt-to-income ratio and credit limit to determine a potential client's creditworthiness, with scope for the consideration of other relevant parameters.

No Integration Necessary

IDM is equipped with ready-to-use templates to support your retail lending risk strategy and can be used with or without integration with internal systems.

Automation

Data obtained and generated is automatically stored for future analysis and the enhancement of decision-making policies.